Shipping crates wait to be loaded in a Chinese port.

HONG KONG (CNNMoney) China is poised to become the world's top trading nation, a position long held by the United States.

China reported Friday that its total trade for 2013 reached $4.2 trillion, a sharp increase over the previous year. It is the first time the world's most populous country has cleared the $4 trillion barrier, a feat accomplished despite lackluster numbers for the final month of the year.

The U.S. has not yet reported trade numbers for December, but China is virtually assured the top ranking.

In the first 11 months of the year, U.S. imports and exports totaled $3.5 trillion, according to the Department of Commerce. To retain the top spot, the U.S. would have to more than double its average monthly performance in December.

Top Shipping Companies To Invest In 2015: Express-1 Expedited Solutions Inc.(XPO)

XPO Logistics, Inc. provides third-party logistics services using a network of relationships with ground, sea, and air carriers in the United States, Mexico, and Canada. It operates in three segments: Express-1, Concert Group Logistics, and Bounce Logistics. The Express-1 segment offers ground expedited surface transportation services for freight. It operates a fleet ranging from cargo vans to semi tractor trailer units. The Concert Group Logistics segment provides domestic and international freight forwarding services through a network of independently owned stations. Its domestic freight forwarding services include air charter, expedites, and time sensitive services, as well as cost sensitive services comprising deferred delivery, less than truckload, and full truck load services; and international freight forwarding services consist of on-board courier and air charters, time sensitive services, less-than-container and full-container-loads, and vessel charters. This segm ent also offers documentation on international shipments, customs clearance and banking, trade show shipment management, time definite and customized product distributions, reverse logistics and on site asset recovery projects, installation coordination, freight optimization, and diversity compliance support services. The Bounce Logistics segment provides premium freight brokerage services for truckload shipments. The company serves approximately 4,000 retail, commercial, manufacturing, and industrial customers through 6 U.S. operations centers and 22 agent locations. It offers its services to the automotive manufacturing, automotive components and supplies, commercial printing, durable goods manufacturing, pharmaceuticals, food and consumer products, and high tech sectors. The company was formerly known as Express-1 Expedited Solutions, Inc. and changed its name to XPO Logistics, Inc. in September 2011. XPO Logistics, Inc. was founded in 1989 and is based in Buchanan, Michi gan.

Advisors' Opinion: - [By Travis Hoium]

What: Shares of XPO Logistics (NYSE: XPO ) jumped 13% today after announcing an acquisition.

So what: The company will pay $365 million for logistics provider 3PD, consisting of $357 million in cash an $8 million in XPO restricted stock. Is will use its own cash and borrow $195 million from Credit Suisse Group for the remainder of the purchase. �

Top Shipping Companies To Invest In 2015: Approach Resources Inc.(AREX)

Approach Resources Inc., an independent energy company, engages in the acquisition, exploration, development, and production of oil and gas properties in the United States. The company primarily holds interests in properties located in the Permian Basin in West Texas, as well as in the East Texas Basin. As of December 31, 2011, it had estimated proved reserves of approximately 77.0 million barrels of oil equivalent, and owned working interests in 638 producing oil and gas wells. Approach Resources Inc. was incorporated in 2002 and is headquartered in Fort Worth, Texas.

Advisors' Opinion: - [By Travis Hoium]

What: Shares of Approach Resources (NASDAQ: AREX ) dropped 10% today after the company released earnings.

So what: Sales rose 33.8% from a year ago, to $44.2 million, and the company swung to a profit of $495,000, or $0.01 per share. After adjusting for one-time items, the company made a profit of $0.07 per share, in line with estimates.�

- [By Ben Levisohn]

Not all stocks are created equal, however, and the analysts expect some stocks to handily outperform others, and their top picks “are poised to deliver long-term, capital-efficient growth…while trading at attractive valuations that currently provide 20%+ upside to our price targets.” Their winners?�Oasis Petroleum (OAS),�Approach Resources (AREX),�Bonanza Creek Energy�(BCEI) and Gulfport Energy�(GPOR), all of which are rated Buy with Oasis also added to Goldman’s conviction list. Investors, however, should avoid �WPX Energy�(WPX), which the analysts rate a Sell. They explain why:

Top Shipping Stocks For 2015: AMERIPRISE FINANCIAL SERVICES INC. (AMP)

Ameriprise Financial Inc., through its subsidiaries, provides a range of financial products and services in the United States and internationally. The company�s Advice and Wealth Management segment offers financial planning and advice, as well as brokerage and banking services primarily to retail clients through its financial advisors. The Asset Management segment provides investment advice and investment products to retail and institutional clients. The Annuities segment offers variable and fixed annuity products to retail customers through affiliated and unaffiliated advisors, and financial institutions. The Protection segment provides various protection products through financial advisors to address the protection and risk management needs of retail clients, including life, disability income, and property-casualty insurance. The company was formerly known as American Express Financial Corporation and changed its name to Ameriprise Financial, Inc. in September 2005. Ame riprise Financial Inc. was founded in 1894 and is headquartered in Minneapolis, Minnesota.

Advisors' Opinion: - [By U.S. News]

Getty Images Recently, a client came to me with a difficult dilemma. He was retired and living comfortably but didn't have much room in his budget for additional expenses. His son was a high-ranking executive with a midsize company. He was married, with three children, all of whom were in private school in New York City. The son lost his job as a consequence of restructuring. He was having difficulty finding another position at anything close to his prior income. He had been looking without success for more than six months. He was at a point where he could no longer meet his substantial monthly expenses. He asked my client to provide the funds necessary to maintain his lifestyle and the education of his children, until he was able to "land on his feet." My client could afford to make these payments for a limited period of time but his retirement plans would be jeopardized if the time period was prolonged and if his son did not pay him back. He asked for my advice. For many Americans, the goal of helping children and grandchildren pay for their education and preserving wealth to leave to their children is an important goal. Unfortunately, the 2008 recession reduced the confidence of investors in their ability to meet those goals. According to a report prepared by Ameriprise Financial (AMP), only 24 percent of those surveyed in 2012 were "very confident" they could help with education and only 16 percent had confidence in their ability to leave an inheritance to their children. What is more troubling is the finding that only one-third of those surveyed felt very confident in their ability to provide adequately for themselves and their family. My client had never discussed his finances with his children. He is not alone. More than one-third of the parents of boomers believe they haven't adequately discussed finances with their children, according to the Ameriprise study. Their children were often reluctant to engage in these discussions with aging parents b

- [By U.S. News]

Getty Images Borrowers have been enjoying historically low interest rates since the Great Recession hit. For those with solid credit histories, taking out a mortgage, auto loan or personal loan has never been cheaper. But all that could change. Rates on 30-year fixed-rate mortgages have started creeping upward, and financial experts say other forms of debt could soon follow suit. "We do anticipate rates going up, but how far and how fast that's going to happen is an open question," says Bradley Roth, managing partner at Kattan Ferretti Financial, a Pittsburgh-based financial planning and investment advisory firm. He expects the rates on 10-year Treasurys, which are currently approaching 3 percent, to reach 3.25 percent before the end of the year and then 4 to 4.25 percent in 2014. A rise in interest rates could soon be reflected throughout the entire financial services space, from credit cards to personal loans to home equity lines of credit. The good news for savers is that rates on deposit accounts could also climb after years of very low, or no, rates of return. Here's a roundup of how to prepare for rising rates, depending on your own money identity: For Savers "Savers should be able to benefit," Roth says, because he expects the rates on certificates of deposit, savings accounts and money market accounts to all go up. However, he warns savers against locking up their money in longer-term products, like CDs, which can make it harder to take advantage of quickly rising rates. Any rise in savings rates, though, will likely come slowly, says Greg McBride, senior financial analyst for Bankrate.com. "The Federal Reserve is still 18 to 24 months away from boosting short-term rates, so that will keep a lid on the savings yield," he says. In the meantime, with deposit rate accounts still low, savers can maximize their rate of return by shopping around, says Richard Barrington, senior financial analyst at MoneyRates.com. Online banks tend to offer higher r

- [By Ian Katz]

��he consumer is still in a holding pattern, still waiting for better employment prospects,��said Russell Price, senior economist at Ameriprise Financial Inc. (AMP) in Detroit.

Top Shipping Companies To Invest In 2015: BIOLASE Inc (BIOL)

BIOLASE, Inc., formerly BIOLASE Technology, Inc., incorporated in 1987, is a medical technology company that develops, manufactures and markets lasers, and markets and distributes dental imaging equipment and other related products designed for applications and procedures in dentistry and medicine. The Company's dental laser systems allow dentists, periodontists, endodontists, oral surgeons, and other specialists to perform a range of dental procedures, including cosmetic and complex surgical applications in a minimally invasive manner. The Company also manufactures and sells disposable products and accessories for its laser systems. The Company's Waterlase and Diode systems use disposable laser tips of differing sizes and shapes depending on the procedures being performed. The Company also markets flexible fibers and hands pieces. For the Company's ezlase system, the Company sells tooth whitening gel kits. In April 2012, it purchased 159 Waterlase MD Turbo laser systems from Henry Schein, Inc.

The Company's Waterlase Dentistry consists of two product lines Waterlase systems and Diode systems. In July 2011, the Company introduced the Biolase DaVinci Imaging line of imaging products, which enabled the Company to offer digital diagnostic solutions to complement the minimally invasive dental treatment solutions offered by its Waterlase and Diode dental systems. The Company added the distribution of the NewTom cone beam computed tomography (CBCT), to its imaging product line. The integration of the Company's laser products with imaging offers dental professionals the Total Technology Solution, which provides imaging capabilities for early diagnosis and minimally invasive treatment with its Waterlase iPlus and iLase laser technologies.

The Company's all-tissueWaterlase dental laser systems consist of the Waterlase iPlus, the Waterlase MD Turbo, and the Waterlase MDX 300 and 450, both introduced in February 2012. Each of these systems is designed around the Company's yttrium scandi! um gallium garnet (YSGG) laser technology that refers to the laser crystal used in the Waterlase system, which contains the elements erbium, chromium and yttrium, scandium, gallium and garnet. This crystal laser produces energy with specific absorption and tissue interaction characteristics optimized for dental applications. HydroPhotonics refers to the interaction of YSGG lasers with water to produce energy to cut tissue. It is minimally invasive and can cut hard tissue, such as bone and teeth, and soft tissue, such as gums or skin, without the heat, vibration, or pressure associated with traditional dental treatments. By eliminating heat, vibration, and pressure, the Company's Waterlase systems eliminate the need for anesthesia.

The Waterlase systems incorporate an ergonomic handpiece and a control panel located on the front of the system with precise preset functionality to control the mix of laser energy, air, and water, as well as the pulse rate. The Waterlase iPlus incorporates the iLase wireless diode laser that can be utilized for unexpected soft-tissue cases in an adjacent treatment room, controlling bleeding, and temporary pain relief.

The Company's Diode laser systems in dentistry consist of the ezlase and iLase, semiconductor diode lasers to perform soft tissue, hygiene, cosmetic procedures, teeth whitening, and temporary pain relief. The Company's ezlase system serves the markets of general, cosmetic, orthodontic and hygienic procedures. It features a pulse mode, ComfortPulse, which allows the tissue to cool between pulses and reduces the need for anesthesia for many common procedures. Other features include a wireless foot pedal control, disposable single-use tips, color touch screen activation with up to fifteen procedure based pre-sets, a whitening hand piece, a rechargeable battery pack, and a wall mount.

The Company's imaging systems include the Company's design and distribution of extra-oral and intra-oral dental digital imaging devices. The Co! mpany's e! xpansion into digital imaging systems enables the Company to offer diagnostic solutions to complement the minimally invasive dental treatment solutions offered by the Company's Waterlase and Diode dental systems. The Company provides both high-precision intuitive diagnosis and treatment planning solutions. The Company's Biolase DaVinci Imaging systems include the D3D, a three dimensional (3D) CBCT, and portable digital x-ray and intra-oral camera devices.

The NewTom VGi is a small-footprint CBCT system that offers medical grade imaging technology. In addition to producing up to image resolution with medical grade rotating anode technology, SafeBeam technology automatically adjusts radiation dosage. The Company's Medical systems include the Diolase 10 Diode Laser. As of December 31, 2011, the Company has sold approximately 8,700 Waterlase systems, including over 4,700 Waterlase MD and iPlus systems, and more than 19,000 laser systems in total in over 60 countries. As of decembe31, 2011, the Company�� other products under development address ophthalmology, dermatology, orthopedics, podiatry, and other medical and consumer markets.

The Company competes with Lares Dental Research, Fotona d.d., KaVo Dental GmbH, Lambda SpA, J Morita Manufacturing Corp., Syneron Medical Ltd, Deka Laser Technologies, Inc. Ivoclar Vivadent, Inc., Dentsply, Inc., Royal Philips Electronics and Sirona Dental Systems, Inc.

Advisors' Opinion: - [By Roberto Pedone]

One health care player that's starting to trend within range of triggering a major breakout trade is Biolase (BIOL), which is a medical technology company that develops, manufactures and markets laser systems for dental and medical applications. This stock is off to a decent start in 2013, with shares up 12%.

If you take a look at the chart for Biolase, you'll notice that this stock has been trending sideways and consolidating for the last two months, with shares moving between $1.64 on the downside and $2.24 on the upside. Shares of BIOL have now started to spike higher right off its 200-day moving average of $1.87 a share. That spike is quickly pushing shares of BIOL within range of triggering a major breakout trade above the upper-end of its recent sideways trading chart pattern.

Traders should now look for long-biased trades in BIOL if it manages to break out above some near-term overhead resistance levels at $2.15 to $2.24 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 627,655 shares. If that breakout triggers soon, then BIOL will set up to re-test or possibly take out its next major overhead resistance levels at $3.50 to $4 a share.

Traders can look to buy BIOL off any weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at $1.85 to $1.80 a share. One can also buy BIOL off strength once it takes out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Top Shipping Companies To Invest In 2015: Cardtronics Inc.(CATM)

Cardtronics, Inc., together with its subsidiaries, provides automated consumer financial services through its network of automated teller machines (ATMs) and multi-function financial services kiosks. As of December 31, 2011, it offered services to approximately 52,900 devices across its portfolio, which included approximately 46,000 devices located in 50 states of the United States, as well as in the U.S. territories of Puerto Rico and the U.S. Virgin Islands; approximately 3,500 devices throughout the United Kingdom; approximately 2,800 devices throughout Mexico; and approximately 600 devices in Canada. The company also deployed approximately 2,200 multi-function financial services kiosks in the United States. Its ATMs and financial services kiosks offer cash dispensing and bank account balance inquiry services, as well as other consumer financial services, including bill payments, check cashing, remote deposit capture, and money transfer services. In addition, the compan y provides various forms of managed service solution, including monitoring, maintenance, cash management, customer service, and transaction processing services. Further, it partners with national financial institutions to brand its ATMs and financial services kiosks with their logos. As of December 31, 2011, the company had approximately 15,400 company-owned ATMs under contract with financial institutions to place their logos on those machines. Additionally, it provides financial institutions with surcharge-free program through its Allpoint network, as well as owns and operates an electronic funds transfer transaction processing platform that provides transaction processing services to its network of ATMs and financial services kiosks, and ATMs owned and operated by third parties. The company was formerly known as Cardtronics Group, Inc. and changed its name to Cardtronics, Inc. in January 2004. Cardtronics, Inc. was founded in 1989 and is headquartered in Houston, Texas.

Advisors' Opinion: - [By Seth Jayson]

Calling all cash flows

When you are trying to buy the market's best stocks, it's worth checking up on your companies' free cash flow once a quarter or so, to see whether it bears any relationship to the net income in the headlines. That's what we do with this series. Today, we're checking in on Cardtronics (Nasdaq: CATM ) , whose recent revenue and earnings are plotted below.

Top Shipping Companies To Invest In 2015: World Wrestling Entertainment Inc.(WWE)

World Wrestling Entertainment, Inc., an integrated media and entertainment company, engages in the sports entertainment business. The company develops content centered around its talent, and presents at its live and televised events featuring World Wrestling Entertainment. It operates through four segments: Live and Televised Entertainment, Consumer Products, Digital Media, and WWE Studios. The Live and Televised Entertainment segment conducts live events; produces television shows; sells merchandise at its live events; provides sponsorships, such as various promotional vehicles, including Internet and print advertising, arena signage, on-air announcements, and pay-per-view sponsorships for advertisers; offers television rights; and markets and promotes the storylines associated with pay-per-view events. It also provides WWE Classics On Demand, a subscription video on demand service that offers classic television shows, pay-per-view events, specials, and original programmi ng. This segment distributes its programming in approximately 30 languages and in approximately 145 countries. Its merchandise consists of various WWE-branded products, such as T-shirts, caps, and other novelty items. The Consumer Products segment licenses and sells retail products, including toys, video games, home videos, apparel, and books; and publishes magazines comprising lifestyle publications with native language editions in the UK, Mexico, Greece, and Turkey. The Digital Media segment operates Web sites; provides advertising services; sells merchandise on its Web site at WWEShop Internet storefront; and offers broadband and mobile content. The WWE Studios segment is involved in the distribution of entertainment films. This segment focuses on creating a mix of filmed entertainment. The company was founded in 1980 and is based in Stamford, Connecticut.

Advisors' Opinion: - [By Jon C. Ogg]

Vince McMahon has built World Wrestling Entertainment Inc. (NYSE: WWE) into global wrestling empire over the years. The company recently launched the WWE Network. The network, which had 667,000 as of April, seems well on its way to reaching its stated goal of 1 million subscribers by the end of this year. Despite some concerns about a shift to online viewing and away from live events and pay-per-view, WWE has managed to steadily grow its revenues. Sales were $508 million in 2013, versus $478 million in 2010. The WWE Network is expected to grow revenues to $581 million in 2014 and to nearly $800 million in 2015. In addition to the network, WWE also hosts Wrestlemania ��the professional wrestling's equivalent of the Super Bowl. Its investors currently receive a 2.8% dividend yield.

Top Shipping Companies To Invest In 2015: Semiconductor Manufacturing International Corporation(SMI)

Semiconductor Manufacturing International Corporation, an investment holding company, engages in the computer-aided design, manufacture, packaging, testing, and trade of integrated circuits. It offers a range of technologies from 0.35μm to 65nm with capabilities that include logic, mixed signal/RF CMOS, high voltage, embedded, flash, EEPROM, and CIS technology. The company also provides portfolio of semiconductor intellectual property (IP) blocks from 0.35um to 65nm to support the design needs of customers; ASIC design services; reference flows; mixed-signal/RF PDKs; and multi-project wafer services. In addition, it involves in the design and manufacture of semiconductor masks; and provides assembly and testing, wafer bumping, and wafer probing/testing services. Further, the company offers marketing related activities; operates convenience stores; and manufactures and trades in solar cell related semiconductor products. Its products are used primarily in mobile, network ing, and wireless local area network applications, as well as in consumer and communications products, including digital television, set-top box, mobile, portable media player, and personal digital assistant applications. The company serves integrated device manufacturers, fables semiconductor companies, and system companies principally in the United States, Europe, and the Asia Pacific. Semiconductor Manufacturing International Corporation was founded in 2000 and is headquartered in Shanghai, the People?s Republic of China.

Advisors' Opinion: - [By Tom Stoukas]

The Swiss Market Index (SMI) rose 0.1 percent to 8,055.23 at the close in Zurich. The equity benchmark has climbed 4 percent this month, extending its gain this quarter to 4.8 percent, as the Federal Reserve refrained from reducing its monthly bond purchases. The gauge has rallied 18 percent so far in 2013, the third-best performance by a European developed market. The Swiss Performance Index gained less than 0.1 percent today.

Top Shipping Companies To Invest In 2015: Greenhill & Co Inc (GHL)

Greenhill & Co., Inc. (Greenhill), incorporated on March 10, 2004, is an independent investment bank focused on providing financial advice on mergers, acquisitions, restructurings, financings and capital raising to corporations, partnerships, institutions and governments. The Company acts for clients located throughout the world from its offices in the United States, United Kingdom, Germany, Canada, Japan, Australia and Sweden. The Company provides advisory services primarily in connection with mergers and acquisitions, financings, restructurings, and capital raisings. On merger and acquisition engagements, it provide a broad range of advice to global clients in relation to domestic and cross-border mergers, acquisitions, and similar corporate finance matters and are generally involved at each stage of these transactions, from initial structuring to final execution. It advises client�� matters, including acquisitions, divestitures, defensive tactics, special committee projects and other important corporate events. It also provides advice on valuation, tactics, industry dynamics, structuring alternatives, timing and pricing of transactions, and financing alternatives.

In the Company�� financing advisory and restructuring practice, the Company advise debtors, creditors, governments, other stakeholders and companies experiencing financial distress as well as potential acquirers of distressed companies and assets. It provides advice on valuation, restructuring alternatives, capital structures, financing alternatives, and sales or recapitalizations. The Company also assists those clients who seek court-assisted reorganizations by developing and seeking approval for plans of reorganization as well as the implementation of such plans. In its private capital and real estate capital advisory business the Company assists fund managers and sponsors in raising capital for new funds and provide related advisory services to private equity and real estate funds and other organizations globally. It ! also advises on secondary transactions.

The Company competes with America Corporation, Barclays Bank PLC, Citigroup Inc., Credit Suisse, Deutsche Bank AG, Goldman Sachs Group, Inc., JPMorgan Chase & Co., Morgan Stanley, UBS A.G., Evercore Partners Inc., Jefferies Group, Inc., Lazard Ltd., Credit Suisse and Park Hill.

Advisors' Opinion: - [By Mark Hulbert]

The stocks are C.H. Robinson Worldwide (CHRW) �, a freight-transportation company; chip maker Cirrus Logic (CRUS) �; independent oil company Forest Oil (FST) �; investment bank Greenhill & Co. (GHL) �; Intrepid Potash (IPI) �, a fertilizer company; retailer J.C. Penney (JCP) �; Quest Diagnostics (DGX) �, a medical diagnostic company; Strayer Education (STRA) �, a for-profit college; Tower Group International (TWGP) �, an insurance company; and Windstream Holdings (WIN) �, a rural telecommunications firm.

- [By Matt Koppenheffer and David Hanson]

An article in Financial Times came out suggesting that smaller investment banks, such as Greenhill (NYSE: GHL ) or Lazard (NYSE: LAZ ) , might be workplaces that offer more options and flexibility for those pursuing a banking career. Will we start to see the best talent move away from Wall Street's biggest banks to find the true opportunities? In the video, Matt tells us what effect this could have on big banking as a whole.

Top Shipping Companies To Invest In 2015: Tropicana Entertainment Inc (TPCA)

Tropicana Entertainment Inc. (TEI) is an owner and operator of regional casino and entertainment properties located in the United States and one casino resort development located on the island of Aruba. TEI�� United States properties include three casinos in Nevada, three casinos in Mississippi, and one casino in each of Indiana, Louisiana and New Jersey. Its properties offer a range of gaming options. TEI�� properties include Tropicana AC in the East; Casino Aztar in Central; Tropicana Laughlin, River Palms and MontBleu in the West; Lighthouse Point, Jubilee, Belle of Baton Rouge, Horizon Vicksburg and Tropicana Aruba in the South and Other.

Tropicana AC

Tropicana Casino and Resort, Atlantic City (Tropicana AC) is situated on a 14-acre site with approximately 660 feet of ocean frontage in Atlantic City, New Jersey. In addition to gaming facilities, the property features The Quarter, a Havana-themed, Las Vegas-style, approximately 200,000 square-foot indoor entertainment and retail center, hosting several restaurants, shops and an IMAX theatre. Other amenities include a 2,000-seat showroom, a full service spa and salon, a health club and indoor pool, a beach and pool bar and approximately 99,000 square feet of meeting and convention space.

Casino Aztar

Casino Aztar Evansville (Casino Aztar) is a casino hotel and entertainment complex in the state of Indiana. Over 60% of Casino Aztar's revenues come from customers within a 50-mile radius. The property's casino operations are located dockside on the three-deck City of Evansville riverboat. Located adjacent to the casino, the Company owns two distinctive hotels: the Casino Aztar Hotel, a 251-room hotel that offers guests a restaurant, conference rooms and banquet facilities; and Le Merigot Hotel, a luxurious 96-room boutique hotel with an upscale martini lounge. A 44,000-square-foot pavilion adjacent to the riverboat features three restaurants, an entertainment lounge, gift shop, coffee shop, pla! yers club and VIP lounge. The District at Casino Aztar includes two restaurants and the Le Merigot Hotel. Casino Aztar also includes a seven-story parking garage, as well as surface parking.

Tropicana Laughlin

Tropicana Laughlin Hotel and Casino (Tropicana Laughlin) is located on an approximately 31-acre site on Casino Drive, Laughlin. The casino at Tropicana Laughlin features a gaming floor. Non-gaming amenities include a heated outdoor swimming pool, seven restaurants, three full service bars, an entertainment lounge with live music, a lounge for high-end players, an 800-seat multi-purpose showroom and concert hall, meeting space, retail stores, an arcade and a covered parking structure. The property features 1,495 hotel rooms.

River Palms

River Palms Hotel and Casino (River Palms) is located on an approximately 35-acre site also on Casino Drive, with approximately 1,300 feet of frontage on the Colorado River. Non-gaming amenities include 1,001 hotel rooms, 10,500 square feet of meeting and convention space, an outdoor pool, fitness center, three restaurants, three full service bars, a showroom, two entertainment lounges with live music and a covered parking structure.

MontBleu

MontBleu Casino Resort & Spa (MontBleu) is situated on approximately 21 acres in South Lake Tahoe, Nevada surrounded by the Sierra Nevada Mountains. In addition to the casino, the property offers guests a choice of three restaurants and various non-gaming amenities, including retail shops, two nightclubs, a 1,500-seat showroom, approximately 14,000 square feet of meeting and convention space, a parking garage, a full service health spa and workout area, an indoor heated lagoon style pool with whirlpool and a 120-seat wedding chapel.

Lighthouse Point

Lighthouse Point Casino (Lighthouse Point) is a 210-foot, three-deck, dockside riverboat located in Greenville, Mississippi. In addition to slot machines, the riverboat inc! ludes a d! eli and bars on each floor while the dockside facility includes a buffet, a bar and 386 onsite surface parking spaces.

Jubilee

Bayou Caddy's Jubilee Casino (Jubilee), a 240-foot dockside riverboat, is located in Greenville. In addition to the casino facilities, the property includes a bar on each floor, a deli and approximately 700 parking spaces. The property also owns and operates the Greenville Inn & Suites, a 41-room suite hotel located less than a mile away, which offers free shuttle service to and from Jubilee and Lighthouse Point.

Belle of Baton Rouge

Belle of Baton Rouge Casino & Hotel (Belle of Baton Rouge) is a dockside riverboat situated on approximately 23 acres on the Mississippi River in the downtown historic district of Baton Rouge, across from the River Center, a 70,000-square-foot convention center. The three-deck, dockside riverboat casino is one of two casino facilities in the Baton Rouge market. Baton Rouge is located 75 miles north of New Orleans. Non-gaming amenities include 300 hotel rooms, 25,000 square feet of meeting and convention space, an outdoor pool, a fitness center, two restaurants, a deli, and an entertainment venue inside a 50,000-square-foot glass atrium that also encloses a tropical lobby.

Horizon Vicksburg

Horizon Vicksburg Casino (Horizon Vicksburg) is a dockside riverboat situated on approximately six acres in downtown Vicksburg, Mississippi. The property features a 297-foot multi-level, antebellum style, dockside riverboat casino housing. Additional amenities include 117 hotel rooms, a restaurant, two covered parking garages as well as additional surface parking. In December 2010, the Company entered into an agreement to sell all of the assets and certain liabilities associated with the operation of Horizon Vicksburg.

Tropicana Aruba

The Company operates timeshare and rental units at Tropicana Aruba Resort & Casino (Tropicana Aruba), a casino resort und! er develo! pment in Noord, Aruba. This resort will have approximately 361 timeshare and rental units, an approximately 16,000 square foot permanent casino, two pools, a swim-up bar & grill, a fitness center and tennis courts, which will be located on approximately 14 acres near Eagle Beach.

Advisors' Opinion: - [By Igor Greenwald]

A majority stake in casino operator Tropicana Entertainment (TPCA) also began with a Chapter 11 restructuring.

From January 1, 2000 to June 10, 2013, Icahn Enterprises has averaged a 20% annual return, multiplying investors' money nearly 12-fold. Berkshire-Hathaway (BRK-B) has managed only a triple over the same span.

) announced on Monday morning that it has agreed to acquire the assets of Small Bone Innovations for $375 million.

) announced on Monday morning that it has agreed to acquire the assets of Small Bone Innovations for $375 million.

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  122.89 (1y: +48%) $(function(){var seriesOptions=[],yAxisOptions=[],name='LLL',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372136400000,83.2],[1372222800000,84.64],[1372309200000,86.03],[1372395600000,85.74],[1372654800000,86.74],[1372741200000,85.06],[1372827600000,85.6],[1373000400000,87.09],[1373259600000,86.98],[1373346000000,88.57],[1373432400000,89.83],[1373518800000,90.2],[1373605200000,90.22],[1373864400000,90.86],[1373950800000,90.25],[1374037200000,91.14],[1374123600000,91.84],[1374210000000,92.37],[1374469200000,92.39],[1374555600000,93],[1374642000000,92.59],[1374728400000,92.04],[1374814800000,92.15],[1375074000000,91.95],[1375160400000,92.54],[1375246800000,93.15],[1375333200000,93.53],[1375419600000,94.32],[1375678800000,93.55],[1375765200000,93.03],[1375851600000,93.19],[1375938000000,93.52],[1376024400000,92.89],[1376283600000,92.95],[1376370000000,93.31],[1376456400000,92.6],[1376542800000,91.43],[1376629200000,91.2],[1376888400000,91.5],[1376974800000,92.1],[1377061200000,91.37],[1377147600000,92.3],[1377234000000,92.65],[1377493200000,92.27],[1377579600000,90.72],[1377666000000,91.09],[1377752400000,90.98],[1377838800000,90.33],[1378184400000,90.56],[1378270800000,91.25],[1378357200000,91.47],[1378443600000,91.19],[1378702800000,92.12],[1378789200000,92.88],[1378875600000,94.17],[1378962000000,93.96],[1379048400000,94.25],[1379307600000,95.76],[1379394000000,95.99],[1379480400000,96.09],[1379566800000,96.07],[1379653200000,95.22],[1379912400000,94.51],[1379998800000,95.52],[1380085200000,95.93],[1380171600000,95.91],[1380258000000,95.43],[1380517200000,94.5],[1380603600000,95.33],[1380690000000,93.93],[1380776400000,92.67],[1380862800000,92.88],[1381122000000,92.65],[1381208400000,91.99],[1381294800000,91.94],[1381381200000,93.56],[1381467600000,93.94],[1381726800000,94.98],[1381813200000,93.71],[1381899600000,94.06],[1381986000000,94.38],[1382072400000,94.77],[1382331600000,94.4],[1382418000000,95],[1382504400000,95.98],[1382590800000,96.29],[1382677200000,97.53],[1382936400! 000,97.1],[1383022800000,97.98],[1383109200000,99.45],[1383195600000,100.45],[1383282000000,100.76],[1383544800000,100.84],[1383631200000,101.05],[1383717600000,102.28],[1383804000000,100.86],[1383890400000,101.5],[1384149600000,101.35],[1384236000000,101.24],[1384322400000,101.87],[1384408800000,101.96],[1384495200000,101.95],[1384754400000,102.86],[1384840800000,101.78],[1384927200000,101.36],[1385013600000,101.86],[1385100000000,102.34],[1385359200000,102.37],[1385445600000,103.01],[1385532000000,103.48],[1385704800000,103.46],[1385964000000,103.19],[1386050400000,102.68],[1386136800000,101.58],[1386223200000,100.81],[1386309600000,101.8],[1386568800000,101.95],[1386655200000,102.38],[1386741600000,100.88],[1386828000000,101.3],[1386914400000,102.23],[1387173600000,103.02],[1387260000000,102.39],[1387346400000,104.78],[1387432800000,104.57],[1387519200000,105.49],[1387778400000,106.03],[1387864800000,106.73],[1388037600000,107.13],[1388124000000,107.12],[1388383200000,106.78],[1388469600000,106.86],[1388642400000,105.08],[1388728800000,105.38],[1388988000000,105.58],[1389074400000,104.74],[1389160800000,105.46],[1389247200000,106.29],[1389333600000,106.32],[1389592800000,105.66],[1389679200000,106.14],[1389765600000,107.28],[1389852000000,107],[1389938400000,107.57],[1390284000000,108.34],[1390370400000,108.62],[1390456800000,107.71],[1390543200000,104.17],[1390802400000,103.71],[1390888800000,104.47],[1390975200000,103.72],[1391061600000,105.41],[1391148000000,111.07],[1391407200000,108.62],[1391493600000,108.33],[1391580000000,108.96],[1391666400000,109.61],[1391752800000,113.02],[1392012000000,112.4],[

122.89 (1y: +48%) $(function(){var seriesOptions=[],yAxisOptions=[],name='LLL',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372136400000,83.2],[1372222800000,84.64],[1372309200000,86.03],[1372395600000,85.74],[1372654800000,86.74],[1372741200000,85.06],[1372827600000,85.6],[1373000400000,87.09],[1373259600000,86.98],[1373346000000,88.57],[1373432400000,89.83],[1373518800000,90.2],[1373605200000,90.22],[1373864400000,90.86],[1373950800000,90.25],[1374037200000,91.14],[1374123600000,91.84],[1374210000000,92.37],[1374469200000,92.39],[1374555600000,93],[1374642000000,92.59],[1374728400000,92.04],[1374814800000,92.15],[1375074000000,91.95],[1375160400000,92.54],[1375246800000,93.15],[1375333200000,93.53],[1375419600000,94.32],[1375678800000,93.55],[1375765200000,93.03],[1375851600000,93.19],[1375938000000,93.52],[1376024400000,92.89],[1376283600000,92.95],[1376370000000,93.31],[1376456400000,92.6],[1376542800000,91.43],[1376629200000,91.2],[1376888400000,91.5],[1376974800000,92.1],[1377061200000,91.37],[1377147600000,92.3],[1377234000000,92.65],[1377493200000,92.27],[1377579600000,90.72],[1377666000000,91.09],[1377752400000,90.98],[1377838800000,90.33],[1378184400000,90.56],[1378270800000,91.25],[1378357200000,91.47],[1378443600000,91.19],[1378702800000,92.12],[1378789200000,92.88],[1378875600000,94.17],[1378962000000,93.96],[1379048400000,94.25],[1379307600000,95.76],[1379394000000,95.99],[1379480400000,96.09],[1379566800000,96.07],[1379653200000,95.22],[1379912400000,94.51],[1379998800000,95.52],[1380085200000,95.93],[1380171600000,95.91],[1380258000000,95.43],[1380517200000,94.5],[1380603600000,95.33],[1380690000000,93.93],[1380776400000,92.67],[1380862800000,92.88],[1381122000000,92.65],[1381208400000,91.99],[1381294800000,91.94],[1381381200000,93.56],[1381467600000,93.94],[1381726800000,94.98],[1381813200000,93.71],[1381899600000,94.06],[1381986000000,94.38],[1382072400000,94.77],[1382331600000,94.4],[1382418000000,95],[1382504400000,95.98],[1382590800000,96.29],[1382677200000,97.53],[1382936400! 000,97.1],[1383022800000,97.98],[1383109200000,99.45],[1383195600000,100.45],[1383282000000,100.76],[1383544800000,100.84],[1383631200000,101.05],[1383717600000,102.28],[1383804000000,100.86],[1383890400000,101.5],[1384149600000,101.35],[1384236000000,101.24],[1384322400000,101.87],[1384408800000,101.96],[1384495200000,101.95],[1384754400000,102.86],[1384840800000,101.78],[1384927200000,101.36],[1385013600000,101.86],[1385100000000,102.34],[1385359200000,102.37],[1385445600000,103.01],[1385532000000,103.48],[1385704800000,103.46],[1385964000000,103.19],[1386050400000,102.68],[1386136800000,101.58],[1386223200000,100.81],[1386309600000,101.8],[1386568800000,101.95],[1386655200000,102.38],[1386741600000,100.88],[1386828000000,101.3],[1386914400000,102.23],[1387173600000,103.02],[1387260000000,102.39],[1387346400000,104.78],[1387432800000,104.57],[1387519200000,105.49],[1387778400000,106.03],[1387864800000,106.73],[1388037600000,107.13],[1388124000000,107.12],[1388383200000,106.78],[1388469600000,106.86],[1388642400000,105.08],[1388728800000,105.38],[1388988000000,105.58],[1389074400000,104.74],[1389160800000,105.46],[1389247200000,106.29],[1389333600000,106.32],[1389592800000,105.66],[1389679200000,106.14],[1389765600000,107.28],[1389852000000,107],[1389938400000,107.57],[1390284000000,108.34],[1390370400000,108.62],[1390456800000,107.71],[1390543200000,104.17],[1390802400000,103.71],[1390888800000,104.47],[1390975200000,103.72],[1391061600000,105.41],[1391148000000,111.07],[1391407200000,108.62],[1391493600000,108.33],[1391580000000,108.96],[1391666400000,109.61],[1391752800000,113.02],[1392012000000,112.4],[

Wilfredo Lee/APA prospective homebuyer checks out a house in Miami Shores, Fla. WASHINGTON -- Sales of previously owned U.S. homes posted the best monthly gain in nearly three years in May, providing hope that housing is beginning to regain momentum lost over the past year. The National Association of Realtors reported Monday that sales of existing homes increased 4.9 percent last month to a seasonally adjusted annual rate of 4.89 million homes. The monthly gain was the fastest since August 2011, but even with the increase, sales are still 5 percent below the pace in May 2013. "Sales appear to be moving up again, although the increase to date -- over two months -- reverses just a fraction of earlier weakening," Jim O'Sullivan, chief U.S. economist at High Frequency Economics, said in a research note. Sales had been dampened by last year's rise in mortgage rates from historic lows and various other factors including tight supplies and tougher lending standards. The median price of a home sold in May was $213,400, up 5.1 percent from a year ago. By region of the country, sales were up the most in May in the Midwest, an 8.7 percent gain which likely reflected further catch-up from the severe winter. Sales rose 5.7 percent in the South and 3.3 percent in the Northeast but showed only a slight 0.9 percent increase in the West. The number of first-time buyers remained stuck near record lows at just 27 percent of sales in May, down from 29 percent in April. Analysts expressed concerns about the scarcity of first-time buyers, who historically have made up around 40 percent of the market. "The existing home sales market can only retain its strength for so long if move-up buyers cannot find a first-time buyer to purchase their starter homes," said Stephanie Karol, an economist at Global Insight. The level of distressed sales -- either foreclosures or short-sales in which the homeowner has to sell for less than the value of the mortgage -- declined to 11 percent of all sales in May, an improvement from 18 percent of all sales a year ago. After hitting a recent peak of 5.38 million sales at an annual rate last July, sales started sliding. Potential buyers have been grappling with a limited supply of houses, more expensive homes and lending standards which have been tightened in response to the housing boom of the past decade which resulted in millions of houses going into foreclosure. Five years into the recovery from a deep recession that was triggered in part by the collapse in housing, housing sales have yet to return to their historic averages. Demand remains strong for the most expensive homes but has faltered for starter homes and those priced for middle class buyers. The pace of home sales is below the 5.1 million homes sold in 2013 and off the pace of 5.5 million annual sales that would be consistent with a healthy housing market. Lawrence Yun, chief economist for the Realtors, said because of the weaker start to sales this year, he expects that sales for the entire year will be down 3.1 percent this year to 4.9 million, compared with 5.1 million sales of existing homes in 2013, which had been a 9.2 percent rise from 2012. Yun said he was predicting a stronger second half for sales this year but he said that would not be enough to compensate for the weakness at the start of this year, a slowdown that reflected in part a harsh winter. Sales of existing homes began to slow in the second half of 2013 as mortgage rates crept up from historic lows, but home prices continued to rise due to a lack of available homes for sale. Average rates for 30-year fixed-rate mortgages declined to 4.17 percent last week, down from 4.20 percent the previous week. Mortgage rates are about a quarter of a percentage point higher than they were at the same time last year. Yun forecast that mortgage rates will be rising at the end of this year as the Federal Reserve moves closer to starting to boost interest rates. He forecast rates would average 4.9 percent in the last three months of this year and 5 percent in the first quarter of 2015. The total inventory of homes for sale at the end of May climbed 2.2 percent to 2.28 million homes, which represents a 5.6-month supply at the May sales pace. Inventory is 6 percent higher than a year ago, which analysts said should help to slow price gains and boost sales by giving would-be buyers more homes to choose from.

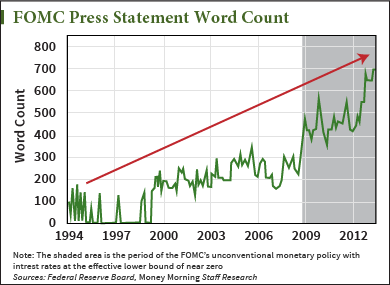

Wilfredo Lee/APA prospective homebuyer checks out a house in Miami Shores, Fla. WASHINGTON -- Sales of previously owned U.S. homes posted the best monthly gain in nearly three years in May, providing hope that housing is beginning to regain momentum lost over the past year. The National Association of Realtors reported Monday that sales of existing homes increased 4.9 percent last month to a seasonally adjusted annual rate of 4.89 million homes. The monthly gain was the fastest since August 2011, but even with the increase, sales are still 5 percent below the pace in May 2013. "Sales appear to be moving up again, although the increase to date -- over two months -- reverses just a fraction of earlier weakening," Jim O'Sullivan, chief U.S. economist at High Frequency Economics, said in a research note. Sales had been dampened by last year's rise in mortgage rates from historic lows and various other factors including tight supplies and tougher lending standards. The median price of a home sold in May was $213,400, up 5.1 percent from a year ago. By region of the country, sales were up the most in May in the Midwest, an 8.7 percent gain which likely reflected further catch-up from the severe winter. Sales rose 5.7 percent in the South and 3.3 percent in the Northeast but showed only a slight 0.9 percent increase in the West. The number of first-time buyers remained stuck near record lows at just 27 percent of sales in May, down from 29 percent in April. Analysts expressed concerns about the scarcity of first-time buyers, who historically have made up around 40 percent of the market. "The existing home sales market can only retain its strength for so long if move-up buyers cannot find a first-time buyer to purchase their starter homes," said Stephanie Karol, an economist at Global Insight. The level of distressed sales -- either foreclosures or short-sales in which the homeowner has to sell for less than the value of the mortgage -- declined to 11 percent of all sales in May, an improvement from 18 percent of all sales a year ago. After hitting a recent peak of 5.38 million sales at an annual rate last July, sales started sliding. Potential buyers have been grappling with a limited supply of houses, more expensive homes and lending standards which have been tightened in response to the housing boom of the past decade which resulted in millions of houses going into foreclosure. Five years into the recovery from a deep recession that was triggered in part by the collapse in housing, housing sales have yet to return to their historic averages. Demand remains strong for the most expensive homes but has faltered for starter homes and those priced for middle class buyers. The pace of home sales is below the 5.1 million homes sold in 2013 and off the pace of 5.5 million annual sales that would be consistent with a healthy housing market. Lawrence Yun, chief economist for the Realtors, said because of the weaker start to sales this year, he expects that sales for the entire year will be down 3.1 percent this year to 4.9 million, compared with 5.1 million sales of existing homes in 2013, which had been a 9.2 percent rise from 2012. Yun said he was predicting a stronger second half for sales this year but he said that would not be enough to compensate for the weakness at the start of this year, a slowdown that reflected in part a harsh winter. Sales of existing homes began to slow in the second half of 2013 as mortgage rates crept up from historic lows, but home prices continued to rise due to a lack of available homes for sale. Average rates for 30-year fixed-rate mortgages declined to 4.17 percent last week, down from 4.20 percent the previous week. Mortgage rates are about a quarter of a percentage point higher than they were at the same time last year. Yun forecast that mortgage rates will be rising at the end of this year as the Federal Reserve moves closer to starting to boost interest rates. He forecast rates would average 4.9 percent in the last three months of this year and 5 percent in the first quarter of 2015. The total inventory of homes for sale at the end of May climbed 2.2 percent to 2.28 million homes, which represents a 5.6-month supply at the May sales pace. Inventory is 6 percent higher than a year ago, which analysts said should help to slow price gains and boost sales by giving would-be buyers more homes to choose from. The first Federal Open Market Committee (FOMC) press statement was released on Feb. 4, 1994, and it was all of a whopping 99 words: short, succinct, and to the point.

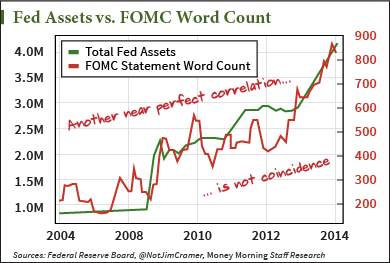

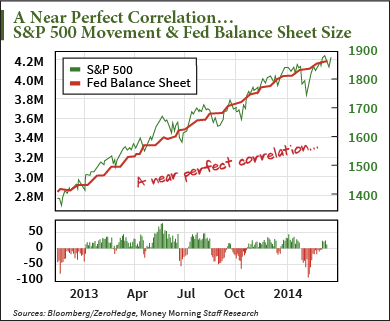

The first Federal Open Market Committee (FOMC) press statement was released on Feb. 4, 1994, and it was all of a whopping 99 words: short, succinct, and to the point. The Fed missed the financial crisis in formation and has been wrong about critical inflation and jobs data for several years in a row now, which means that it's got to "explain" itself in other ways.

The Fed missed the financial crisis in formation and has been wrong about critical inflation and jobs data for several years in a row now, which means that it's got to "explain" itself in other ways. It's one thing to say that the Fed is simply doing a better job of communicating. And entirely another when you realize why...

It's one thing to say that the Fed is simply doing a better job of communicating. And entirely another when you realize why...

Butch Dill/AP . If all goes according to plan, my last student loan will be paid in full this June. I'll be debt-free at 29. The thing is, nearly $40,000 and eight years later, I know how to be in debt. Debt-free? Not so much. I'm good at being in debt. I know how to juggle payments and budget for automatic debits and track my payoff progress. I know what I'm supposed to do with my money when I'm in debt: Use it to pay my debts down. When I'm debt-free, what should I do with my extra cash? Save for retirement? Take a vacation? The options are overwhelming, and I'm afraid I'll make the wrong choice. I feel like paying off my student loans represents some kind of line in the sand: On one side, it's O.K. to be unsure and unsettled. On the other side, it's not. I'm moving toward that other side, and I haven't made it to sure and settled quite yet. How I Got Used to Living With Debt My relationship with debt began at the tender age of 21, when I started my one-year master's program in education.

Butch Dill/AP . If all goes according to plan, my last student loan will be paid in full this June. I'll be debt-free at 29. The thing is, nearly $40,000 and eight years later, I know how to be in debt. Debt-free? Not so much. I'm good at being in debt. I know how to juggle payments and budget for automatic debits and track my payoff progress. I know what I'm supposed to do with my money when I'm in debt: Use it to pay my debts down. When I'm debt-free, what should I do with my extra cash? Save for retirement? Take a vacation? The options are overwhelming, and I'm afraid I'll make the wrong choice. I feel like paying off my student loans represents some kind of line in the sand: On one side, it's O.K. to be unsure and unsettled. On the other side, it's not. I'm moving toward that other side, and I haven't made it to sure and settled quite yet. How I Got Used to Living With Debt My relationship with debt began at the tender age of 21, when I started my one-year master's program in education.  Courtesy: Lyndsay Meredith via LearnVestThe author I was lucky enough to have my parents pay for my undergraduate degree, so the concept of being in debt was abstract, and I was blasé. After all, this was before the recession, when credit cards were handed out like candy bars on college campuses and everyone I knew was up to their eyeballs in debt. I quite literally didn't think twice about signing on to $25,000 in student loans, or getting a candy bar -- er, credit card -- and charging it to the max. I'd pay it off later, right? By the time I started my first "real" job as a high school history teacher in the fall of 2007, I had come to rely on that credit card. Living in one of the most expensive zip codes in the nation, near Washington, D.C., didn't help matters. My rent ate up over half of my monthly income, and I had so many other bills to pay that I was barely able to make a dent in my debt. Around the time I got that first job, I had taken out a personal loan to pay off my credit card debt at a lower interest rate than the card offered. Smart, right? Well, not if you turn around and charge your credit card up again ... which, of course, I did. At the point that I realized I had almost doubled my debt to nearly $40,000 in less than a year -- a low, low moment that led to my first full-blown panic attack -- I vowed to get my finances under control. Almost overnight, I started working more and spending less. I froze my credit card in a block of ice and switched to using only cash. I canceled my cable, stopped eating out and signed on to work in every after-school tutoring program that would take me. I even had a friend cut my hair to save money on salon costs. I had no free time and got very little sleep during those months, but I didn't care: I was going to pay off my credit cards or I was going to die trying. My All-Out Effort to Whittle It Down I used the extra cash to pay off my $6,000 of credit card debt, then my $5,500 private student loan, then my $10,000 car loan. I was good at being in debt, and I got really good at paying it off; I had become addicted to the high that came with cutting down the balance of a loan. I started to live for the pleasure of seeing a $0.00 in the 'total due' section of my online accounts. To be honest, I started to become a little insufferable after a while -- I was a woman obsessed, and nothing was going to stop me from becoming debt-free. However, I slowed down once my only remaining debt was $10,000 of my $18,500 federal student loan. I knew that at the end of my rapidly approaching seventh year of teaching I would be entitled to student loan forgiveness, because I was teaching at a Title I (high-poverty) school. So, ready for a break from the extreme frugality of the last five years, I decided to just make minimum payments until that time. Besides, my minimum of $219.72 per month was hardly a king's ransom -- I could definitely live with that payment for a few more years. Slowly, I started loosening the purse strings. I got my cable back, and rehired my hairstylist. I allowed myself to get takeout once a week and went on a few weekend trips. Life was feeling comfortable again, and much less stressful -- I wasn't wasting money, but I wasn't driving myself nuts trying to conserve it either. Then, about six months ago, I started thinking about how my life would be changing soon. My debt would be gone -- for good. It suddenly occurred to me that I'd have to make real decisions about what to do next with my finances and, by extension, my life. And that is when I started to panic. Why It's Hard Saying Goodbye Deep down I know that the reason I'm not as enthusiastic about my student loan payoff as I should be is because to me, those payments represent my last tie to my early adulthood, a time when the world seemed full of possibilities and my optimism was endless, and I'm holding on to that tie for dear life right now. Because "full of possibilities" and "optimistic" are definitely not how I would describe my outlook at the moment. Take, for example, my career. For the first five years of teaching, I was one of the happiest public educators in the profession. But recently, the job has changed substantially, in ways I don't particularly like. (Since I'm still reporting to the classroom every day, I'm not going to get into how, but suffice it to say that for the first time ever, I have to force myself out of bed in the morning.) I don't like this feeling, and I want to go back to the time when I was excited about going to work.

Courtesy: Lyndsay Meredith via LearnVestThe author I was lucky enough to have my parents pay for my undergraduate degree, so the concept of being in debt was abstract, and I was blasé. After all, this was before the recession, when credit cards were handed out like candy bars on college campuses and everyone I knew was up to their eyeballs in debt. I quite literally didn't think twice about signing on to $25,000 in student loans, or getting a candy bar -- er, credit card -- and charging it to the max. I'd pay it off later, right? By the time I started my first "real" job as a high school history teacher in the fall of 2007, I had come to rely on that credit card. Living in one of the most expensive zip codes in the nation, near Washington, D.C., didn't help matters. My rent ate up over half of my monthly income, and I had so many other bills to pay that I was barely able to make a dent in my debt. Around the time I got that first job, I had taken out a personal loan to pay off my credit card debt at a lower interest rate than the card offered. Smart, right? Well, not if you turn around and charge your credit card up again ... which, of course, I did. At the point that I realized I had almost doubled my debt to nearly $40,000 in less than a year -- a low, low moment that led to my first full-blown panic attack -- I vowed to get my finances under control. Almost overnight, I started working more and spending less. I froze my credit card in a block of ice and switched to using only cash. I canceled my cable, stopped eating out and signed on to work in every after-school tutoring program that would take me. I even had a friend cut my hair to save money on salon costs. I had no free time and got very little sleep during those months, but I didn't care: I was going to pay off my credit cards or I was going to die trying. My All-Out Effort to Whittle It Down I used the extra cash to pay off my $6,000 of credit card debt, then my $5,500 private student loan, then my $10,000 car loan. I was good at being in debt, and I got really good at paying it off; I had become addicted to the high that came with cutting down the balance of a loan. I started to live for the pleasure of seeing a $0.00 in the 'total due' section of my online accounts. To be honest, I started to become a little insufferable after a while -- I was a woman obsessed, and nothing was going to stop me from becoming debt-free. However, I slowed down once my only remaining debt was $10,000 of my $18,500 federal student loan. I knew that at the end of my rapidly approaching seventh year of teaching I would be entitled to student loan forgiveness, because I was teaching at a Title I (high-poverty) school. So, ready for a break from the extreme frugality of the last five years, I decided to just make minimum payments until that time. Besides, my minimum of $219.72 per month was hardly a king's ransom -- I could definitely live with that payment for a few more years. Slowly, I started loosening the purse strings. I got my cable back, and rehired my hairstylist. I allowed myself to get takeout once a week and went on a few weekend trips. Life was feeling comfortable again, and much less stressful -- I wasn't wasting money, but I wasn't driving myself nuts trying to conserve it either. Then, about six months ago, I started thinking about how my life would be changing soon. My debt would be gone -- for good. It suddenly occurred to me that I'd have to make real decisions about what to do next with my finances and, by extension, my life. And that is when I started to panic. Why It's Hard Saying Goodbye Deep down I know that the reason I'm not as enthusiastic about my student loan payoff as I should be is because to me, those payments represent my last tie to my early adulthood, a time when the world seemed full of possibilities and my optimism was endless, and I'm holding on to that tie for dear life right now. Because "full of possibilities" and "optimistic" are definitely not how I would describe my outlook at the moment. Take, for example, my career. For the first five years of teaching, I was one of the happiest public educators in the profession. But recently, the job has changed substantially, in ways I don't particularly like. (Since I'm still reporting to the classroom every day, I'm not going to get into how, but suffice it to say that for the first time ever, I have to force myself out of bed in the morning.) I don't like this feeling, and I want to go back to the time when I was excited about going to work.  Jenny Pfanenstiel moved from Chicago to Louisville, Ky., this year to open her first brick-and-mortar hat shop. NEW YORK (CNNMoney) Kentuckians -- grab yourself a mint julep, there's news to celebrate: the Bluegrass State is making improvements to welcome small businesses into the fold -- and it's working.

Jenny Pfanenstiel moved from Chicago to Louisville, Ky., this year to open her first brick-and-mortar hat shop. NEW YORK (CNNMoney) Kentuckians -- grab yourself a mint julep, there's news to celebrate: the Bluegrass State is making improvements to welcome small businesses into the fold -- and it's working.  Inside one of UPS' busiest days

Inside one of UPS' busiest days