Far larger houses are routinely torn down across Arlington to make way for six-bedroom, five-bathroom abodes that are four or five times the size.

But the new homeowner and her architects, Paola Lugli and Paola Amodeo, could not bear to tear down the house, a Sears kit home built in 1926, as part of the original subdivision. It was well cared for, with the original door frames and wooden shingles. The house, with about 960 square feet of living space, just wasn't big enough for the new owner and her two children.

There was space in the yard to build up and out. But the architects wanted to avoid the sort of oversized additions that have become commonplace in Arlington County, where, Lugli said, "it looks like the house ate the house."

So she and Amodeo came up with another idea: give the Sears house away to someone who is willing to preserve it and move it to a new location.

"We need someone with an adventurous spirit," Amodeo said. "Someone who can appreciate the project."

But giving away a house, it turns out, is not as easy as it sounds. This one comes with strings attached — hauling away the nearly 88-year-old home could run as much as $50,000, Lugli estimated.

"The fact the owner is willing to pursue alternatives is great," said Cynthia Liccese-Torres, the county's preservation program coordinator. "But I don't know if they will succeed."

Moving a house is quite a project. Utilities have to be disconnected. The front and back porches need to be removed. Only then can the house be hoisted from its foundations and placed on a truck that can take it to its new location. The new site has to be prepared, too, with a basement, a foundation and utilities in place, ready to go.

Even with those costs, the Lyon Park house still might be a bargain in pricey Arling! ton, where buyers regularly shell out upward of $600,000 just to buy a house they plan to tear down and replace.

The farther away the new location is, the more expensive it becomes to move the house, Liccese-Torres said. Ideally, the Lyon Park house would land somewhere close by. But Kathy Holt Springston, a Cherrydale resident and Sears house buff, said the new owner would run into another problem: "Arlington is so built up there are so few vacant lots to move it to."

The Lyon Park house is one of around 70,000 that Sears, Roebuck and Co. sold in the United States between 1908 and 1940, according to Preservation Arlington, a nonprofit group that works to protect and improve Arlington's architecture. There are roughly 100 confirmed Sears homes in the county, said Liccese-Torres. Most of them are located in Lyon Park, Ashton Heights and Aurora Highlands and are not legally protected from demolition. Liccese-Torres estimated about 59 have been torn down.

There were hundreds of varieties of Sears homes, from modest to mansion-like. The house being given away is known as a Wellington model, which, according to a Sears ad from the era, "has been built in many of the choicest locations and is admired wherever it is built." The lot on which it sits originally sold for just under $2,000.

The owner, who asked not to be identified for privacy reasons, purchased the property in September for $750,000, county records show. To meet her needs, the house would have to be expanded, and zoning rules made an addition to the house infeasible.

In those situations, most people would have called in the bulldozer. But demolishing the house would go against the architects' philosophy, Lugli said, and the oath she was required to take when she became a registered architect in France. ("It's like the oath doctors take," she said.)

The home they plan to build on the lot once the Sears house is gone will be at least twice as big and more modern.

But first, they need to clear the lot.

"I had this really romantic idea," Lugli said.

"She was imagining a parade of sorts," Amodeo said, smiling.

Next, the pair tried giving it to Habitat for Humanity and spoke with officials there. But that went nowhere, so the architects and the homeowner settled on their current plan.

Last month, they went public with their pitch to find the Sears house a good home, in an article posted on Preservation Arlington's Web site. The title of the post was "Free Sears House ... Some Assembly Required." ''The house is not for sale," it read, "but free to a caring new owner."

The owner has left it up to Lugli and Amodeo, who run the firm Paolasquare International, to vet the flurry of inquiries that have come in so far. Only a handful have turned out to be serious. Many of the people who wrote in mistakenly believed the house and the lot were up for grabs, Amodeo said, and didn't understand that they would have to handle the logistics and the cost of moving it.

Lugli and Amodeo said they are open to different types of reuses, not just residential. Although they would have no control over what happens to the Sears house, they hope it could be turned into a community center, an office or even a restaurant.

"We are hoping someone will love it for what it is," Amodeo said.

(1).jpg)

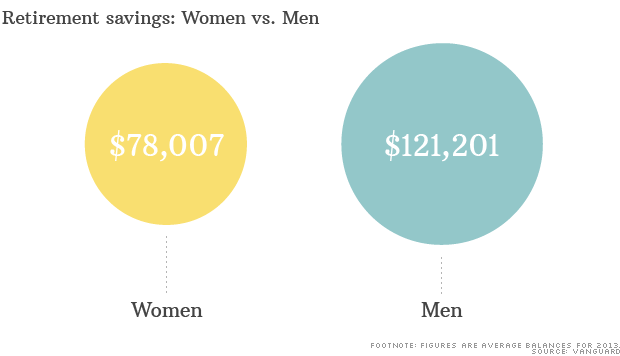

Planning young: a retirement roadmap NEW YORK (CNNMoney) When it comes to putting money away for retirement, women outmatch men:

Planning young: a retirement roadmap NEW YORK (CNNMoney) When it comes to putting money away for retirement, women outmatch men:

Reuters

Reuters

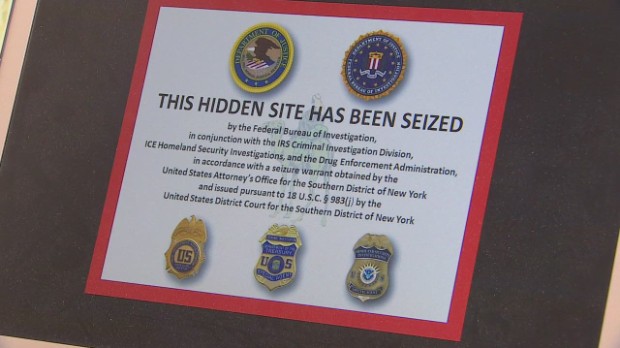

What you need to know about the Silk Road trial NEW YORK (CNNMoney) Over a year ago, the feds took down an unregulated online marketplace commonly dubbed "eBay for drugs." Now, they're going after the man they believe is the site's mastermind.

What you need to know about the Silk Road trial NEW YORK (CNNMoney) Over a year ago, the feds took down an unregulated online marketplace commonly dubbed "eBay for drugs." Now, they're going after the man they believe is the site's mastermind.