Getty Images By Juliette Fairley In the pursuit of the Hollywood dream at age 25, Shequeta Smith moved from North Carolina to Los Angeles in 2004. She rented a room from a friend and began visualizing a place to call her own. "I wrote down exactly what I wanted on a piece of paper, and I still have that paper," Smith told MainStreet. The screenwriter and director imagined paying only $600 for a rental with a parking spot in Sherman Oaks, one of the wealthier enclaves in the sprawling city. But now a decade later she is looking to relocate to become a homeowner. Smith is one of the 48 percent of millennials who plan to move so they can own in the next five years, according to a study by The Demand Institute. "Most millennials want to own a home," said Louise Keely, president of TDI and senior vice president with Nielsen (NLSN). "But those who are currently renting may have trouble saving money for a down payment, because apartment rents have increased more quickly than their income." "It's hard to save money for a down payment, because of the cost of living," Smith said. "But once I make it in the film industry, I will buy a house outright in Charlotte and travel back and forth to Los Angeles for filmmaking." The Dream of Homeownership with a Twist TDI's "Millennials and Their Homes: Still Seeking the American Dream" found that the average millennial has $5,000 in debt and only $3,000 in savings outside of retirement. "Their net debt doesn't look like they are in a position to put a sizable down payment on a house, so saving money is an issue for millennials," Keely told MainStreet. As a result, more millennials are looking to alternative approaches to home ownership, with 69 percent saying they'd consider lease-to-own as one way. "Many are open to alternative approaches to housing finance, including single-family rentals and hybrid contracts such as lease-to-own," said Jeremy Burbank, vice president with TDI and Nielsen. A Different Job Market That's partly because the job market that millennials face differs from that of young adults in previous decades. "Unemployment is higher for millennials than older adults, which has slowed their household formation and their movement into homeownership," said Keely. Although the study further found that 44 percent of millennials think it's hard to qualify for a mortgage, most millennials are undeterred about long-term aspirations to own a home. About 51 percent of college grads aged 30 to 34 with debt own homes, compared to 67 percent of college graduates with no debt. The national average of homeownership is 65 percent. "The homeownership rate is lower for those who have student loan debt, but it's still higher than those who didn't go to college at all," said Keely. "Our findings indicate that student loan debt delays homeownership but does not cripple it." Multiple Alternatives One alternative to traditional home-buying is leasing-to-own, which locks a tenant in to the right to buy a home at a later date at a set price after putting down a non-refundable deposit. In some cases, part of the monthly rent goes toward the downpayment. Other alternatives to a mortgage include single family rentals, shared equity and long-term leases. Types of shared equity include cooperatives, private sector subsidies and land trusts. "An example of shared equity homeownership is when a municipality owns the land and builds the house while the homeowner owns the structure but not the land," Keely said. Long-term leases are another alternative to one- or two-year rentals by extending leases to 30 years, for example. "In the U.K., a leasehold is when you have a long-term lease as opposed to a freehold, where you own the property outright," said Keely. "With a long-term lease, the resident has the comfort of staying in the home a long time." Gen Y Housing Boost Despite their financial circumstances, the study found that millennials will spend $1.6 trillion on home purchases and $600 billion on rent in the next five years. "Millennials are an important factor in housing market activity," Keely said. "Their aspirations to own homes, move to the suburbs and drive a car are similar to [those of] older adults." Because many are still single with no children, millennials also contribute to the economy in a unique way. "They move more often than older adults, which creates turnover," said Keely. "Moving contributes to the economy quite a bit. It's a trigger for other types of consumption, creating income and revenue for various industries."

Getty Images By Juliette Fairley In the pursuit of the Hollywood dream at age 25, Shequeta Smith moved from North Carolina to Los Angeles in 2004. She rented a room from a friend and began visualizing a place to call her own. "I wrote down exactly what I wanted on a piece of paper, and I still have that paper," Smith told MainStreet. The screenwriter and director imagined paying only $600 for a rental with a parking spot in Sherman Oaks, one of the wealthier enclaves in the sprawling city. But now a decade later she is looking to relocate to become a homeowner. Smith is one of the 48 percent of millennials who plan to move so they can own in the next five years, according to a study by The Demand Institute. "Most millennials want to own a home," said Louise Keely, president of TDI and senior vice president with Nielsen (NLSN). "But those who are currently renting may have trouble saving money for a down payment, because apartment rents have increased more quickly than their income." "It's hard to save money for a down payment, because of the cost of living," Smith said. "But once I make it in the film industry, I will buy a house outright in Charlotte and travel back and forth to Los Angeles for filmmaking." The Dream of Homeownership with a Twist TDI's "Millennials and Their Homes: Still Seeking the American Dream" found that the average millennial has $5,000 in debt and only $3,000 in savings outside of retirement. "Their net debt doesn't look like they are in a position to put a sizable down payment on a house, so saving money is an issue for millennials," Keely told MainStreet. As a result, more millennials are looking to alternative approaches to home ownership, with 69 percent saying they'd consider lease-to-own as one way. "Many are open to alternative approaches to housing finance, including single-family rentals and hybrid contracts such as lease-to-own," said Jeremy Burbank, vice president with TDI and Nielsen. A Different Job Market That's partly because the job market that millennials face differs from that of young adults in previous decades. "Unemployment is higher for millennials than older adults, which has slowed their household formation and their movement into homeownership," said Keely. Although the study further found that 44 percent of millennials think it's hard to qualify for a mortgage, most millennials are undeterred about long-term aspirations to own a home. About 51 percent of college grads aged 30 to 34 with debt own homes, compared to 67 percent of college graduates with no debt. The national average of homeownership is 65 percent. "The homeownership rate is lower for those who have student loan debt, but it's still higher than those who didn't go to college at all," said Keely. "Our findings indicate that student loan debt delays homeownership but does not cripple it." Multiple Alternatives One alternative to traditional home-buying is leasing-to-own, which locks a tenant in to the right to buy a home at a later date at a set price after putting down a non-refundable deposit. In some cases, part of the monthly rent goes toward the downpayment. Other alternatives to a mortgage include single family rentals, shared equity and long-term leases. Types of shared equity include cooperatives, private sector subsidies and land trusts. "An example of shared equity homeownership is when a municipality owns the land and builds the house while the homeowner owns the structure but not the land," Keely said. Long-term leases are another alternative to one- or two-year rentals by extending leases to 30 years, for example. "In the U.K., a leasehold is when you have a long-term lease as opposed to a freehold, where you own the property outright," said Keely. "With a long-term lease, the resident has the comfort of staying in the home a long time." Gen Y Housing Boost Despite their financial circumstances, the study found that millennials will spend $1.6 trillion on home purchases and $600 billion on rent in the next five years. "Millennials are an important factor in housing market activity," Keely said. "Their aspirations to own homes, move to the suburbs and drive a car are similar to [those of] older adults." Because many are still single with no children, millennials also contribute to the economy in a unique way. "They move more often than older adults, which creates turnover," said Keely. "Moving contributes to the economy quite a bit. It's a trigger for other types of consumption, creating income and revenue for various industries."

Sunday, September 28, 2014

Millennials Eye Alternative Paths to the Dream of Homeownership

Friday, September 26, 2014

IBM On the Right Track for Continued Growth

International Business Machines (IBM) reported solid 34% growth in its earnings for the second quarter. IBM displayed comprehensive progress in cloud computing, Big Data, Analytics, security and technology fields that are part of its transformation model. However, its core business such as hardware, computer service and weak software revenue remains at risk, and pressurized its revenue in total.

A closer look at the results

Nevertheless, IBM topped the analysts' estimates on both the top and bottom lines. Its net income rose 28% in the quarter to $4.1 billion, or diluted earnings of $4.32 per share, compared to $3.2 billion, or diluted earnings of $3.22 per share in the same quarter last year. However, its revenue dipped nearly -2.25% to $24.36 billion year over year. Analysts had been modeling diluted earnings of $4.30 per share on revenue of $24.13 billion.

Looking forward, the company is investing heavily in various potential markets it has under its belt such as cloud and security, software solutions, application outsourcing, and mobile business that should drive its growth. Moreover, it's strategic move such as broadening its SoftLayer cloud hubs business, its new platform-as-a-service to gear up deployment of hybrid clouds, expanding ecosystem, and enlarging its mobile business, highlight sound prospects for the company that should help the IBM to deliver good margins in the future.

Investments

In addition, IBM has invested $1.2 billion in its SoftLayer cloud hubs business, and launched BlueMix as its new platform-as-a-service that will enhance its capabilities in the deployment of hybrid clouds. IBM has also opened a number of new SoftLayer data centers across the world. IBM has key cloud centers in almost all regions and the company is determined to double its SoftLayer centers with 40 cloud datacenters in more than 15 countries.

Its front office transformation has been very impressive as IDC has ranked IBM number one in both Overall Business Consulting and Cloud Professional Services. Its mobile consulting services has been ranked number one by Forrester, which will help company to gain further market share in the segment.

IBM also announced divestment of its customer care or BPO, and the company is all set to sell its industry standard low-end server business to its partner Lenovo, which will allow IBM to right-size the business to the market dynamics and further enhance its growth.

Moreover, IBM has just announced an investment of $3 billion in research and early-stage development over the next five years to develop next-generation chip technologies that will add value to its emerging cloud, big data, mobile computing, security and cognitive systems. The company has just announced New Big Data capabilities on its IBM cloud marketplace. These new cloud services should help the enterprises with added interactive content which are usable and secure, and can deliver better results and improve the decision-making process. The enterprises now will be able to easily access this new Big Data services as it is available on any device.

Additionally, IBM has formed a strategic partnership with Apple to provide a new level of business value from mobility for enterprise clients that should fuel up its sales for the enterprise business in the upcoming quarters. IBM now looks strong with this partnership to deliver a new class of enterprise ready, MobileFirst business applications for iOS.

These strategic initiatives will also allow IBM to expand its mobile device productivity, enabling big data and analytics at the point of contact with its consultants and other client-facing specialist. These moves will certainly enhance its enterprise capabilities with its unique strength and innovations that will create a competitive edge over its peers in the emerging markets of enterprise IT.

IBM has also ramped up the shipment for its POWER8, and expanded its OpenPOWER consortium during the quarter. The company now has more than 36 members across 10 countries, including nine in China. This membership is more diverse and includes chip designers, hardware component OEMs, system vendors, middleware and software providers, opening great opportunity for the company to tap the underlying growth in emerging markets such as cloud computing, Big Data, Analytics, security and technology. These alliance members can now design and control their own encryption, accessing high end technology though Power architecture, which is now available for open development and to integrate new designs into their hardware platforms.

More catalysts

IBM also looks good in its Flash System with a few new launches such as V7000 update to its Storwize portfolio and Flash-enabled DS8K. Flash system had achieved a double digit growth in the quarter and revenue from its Storwize portfolio now has doubled. IBM also sees a continuous demand for its Flash System across the world that should help the company to offset its underperforming segments such as hardware and computer service.

IBM also witnessed strong momentum for its security software middleware that is driving its software performance. It continues to see strong client demand and stunning r

Saturday, September 20, 2014

5 Secrets to Increasing the Profit of Your Rental

Last week we shared with you a step-by-step guide to purchase a buy-and-hold property. Closing on a deal that meets your goals is fantastic.

But it's only half the battle. I am here this week to tell you about the other half of the equation -- keeping it profitable. To actually achieve those profit goals you set in your budget, you need to constantly monitor your investment's performance and tweak things as you move along.

The first thing you need to do after a purchase is what I call stabilizing the property. This means doing the upfront repairs, getting out the bad tenants, getting the good tenants on your lease contract, and getting your long-term financing in place. Once all that is done, then you go into the long-term phase of landlording -- maintaining profitability.

In my 10 years of investing, I have found some key actions that can make a world of difference in maintaining profitability. Here they are in no particular order.

5 ways to maintain profitability1. Keep your leases current and at market

When I purchase a building with tenants, the lease contracts are usually mismanaged. I find that the leases are month-to-month and at least 15% below market. Typically, this is because the landlords were not tracking the expiration dates of their leases. They were simply letting the original contract with the original rent stay in place.

We purchased an 18-unit building this year. One of the tenants had a lease that had been in place since 1979, and that person's rent had only increased three times in that entire period!

Most residential leases are one-year contracts and either auto-convert to month-to-month or automatically renew for another year after the first year is up (this may not even be legal in your state, even if your lease calls for it). Neither scenario is good in my opinion.

A month-to-month lease is not good because the tenant can terminate the contract with very short notice -- normally 30 days. The good side of this is that the landlord can change the terms of the lease with the same notice as well. This fact is a huge downside for the tenant and is usually the incentive I use to enroll good tenants in a renewal lease versus staying in a month-to-month agreement. I will forgo the landlord's benefits of a month-to-month lease in lieu of having the stability of at least a one-year contract with a good tenant in place.

An auto-renewed lease is not good for you either, even if the lease has a rental increase built in. If you miss the deadline, you can't make changes. If you rent in an area that does not have rent control, you may be leaving money on the table. What if market-rate rents have increased substantially? There are also other things you may want to change aside from the rent.

What if you added amenities to the building like designated parking spaces, or if you separated the utilities? If you let the lease auto-renew, all the terms of the old contract stay in place, including the rent.

So the bottom line is that it pays to visit your lease contracts every year. Mark the date that you have to put a renewal in front of your tenant on your calendar. When that date comes up, take the opportunity to restructure things if you need to. All we do is send the tenants a one-page renewal with any lease changes, the new rent amount, and the date it takes effect. They have a certain number of days to sign it and return it, and we are both protected by a current contract.

2. Budget for and monitor expenses

It sounds funny to say that you need to expect to spend some money maintaining your rental portfolio, right? That being said, there are many landlords who don't project what their expenses are going to be for the current year. If you are one of those landlords, all I can say that if you don't plan for expenses to come up, then every expense that does will be an unwelcome surprise.

Having a budget will not only allow you to project how much money you are going to spend; it also allows you to know how much you are going to make. When Liz and I were looking to have a baby, we needed to know what our income would be a year ahead. Because we have solid financials, I was able to make financial projections that I could stand behind. When our son, Zachary, joined us, we had enough confidence in our financial stability for Liz to take some time off to be with him.

Additionally, if you plan on enrolling investors in your business, it's imperative to have solid financial projections. We are able to tell our investors where our profitability will stand not just next year, but three to five years out.

It's not that hard to create a budget. If you have owned the property for more than a year, all you need to do is look back at what you paid through the prior year. If you are already using accounting software, this is as simple as running a report. If not, just go through your prior year and categorize everything into a spreadsheet. Assuming no major one-time expenses came up (see Item 3 coming up, on capital improvements), you can project that what you will pay in expenses this year will be similar to the prior year. I even mark up my expenses from the last year by a few percent to factor for inflation.

3. Set aside for capital

Capital improvements are things you do to your rental that improve the value of the property. In accounting terms, they are not a one-year expense like a utility expense or maintenance repair would be. They are capitalized into the value of the building -- adding their cost to the value of the property -- and depreciate over time.

Typical examples are roof replacements and new furnaces. You can also apply major renovations, new appliances, cabinets, and windows as capital improvements if you can say that they add to the value of the property. It's a good conversation to have with your CPA before tax time comes around.

That being said, if you don't set aside a few dollars each month to cover these things when they come up, you can end up blowing your annual budget when the furnace needs to be replaced. By setting aside some money per unit into a side savings account, you will develop a capital improvement fund for things like roof replacements or other major expenses that could be capitalized. A good rule of thumb in my area is $400 per unit per year.

4. Plan for preventative maintenance

Some landlords wait for problems to occur before they send someone out to do a repair. That can be very costly, as the tenant may not make you aware of an issue until it gets way out of hand. Little things can turn into big things, and you can't wait for a tenant to decide when you should do some upkeep on your investment.

We do preventative-maintenance walkthroughs on all our properties twice per year. We carry along a checklist and look for two kinds of issues during our walkthrough -- proactive repairs and opportunities to reduce expenses.

Proactive repairs can be done immediately at a reasonable price, before they become a big expense or liability. The small roof leak the tenant didn't want to bother you with will turn into a larger one, sooner or later. The smoke detector with the dead battery is unsafe for the tenant and a liability issue for you. The broken gutter downspout will eventually cause a water leak in your roof or basement. The list goes on and on. You can schedule to address these small things in a reasonable timeframe versus addressing them when they become an expensive emergency.

Expense reductions are ways that we as the landlords can reduce our overhead on the building, primarily by reducing utility expenses on multi-family properties. Put simply, we find things that are leaking that aren't supposed to be! That includes faucets, toilets, window seals, and door seals. We own a few four-unit buildings that are identical and right next door to each other. When I got the water bill, I saw that Building A had a water bill that was $200 higher than Building B for the same quarter. On a site inspection the culprit was found -- a toilet in a tenant's apartment was running all the time!

A simple fix and savings of $800 per year.

5. Evict

If you did smart profit projections for your property, you included a line item for vacancy, even for a single-family home. To maintain or beat that vacancy rate, you can't allow a tenant to stay in a unit for any longer than a month without paying -- the reason being that if you have the person removed, you will still need to spend the time and money to get the apartment turned around for the next occupant.

Filing eviction is tough. Even I have a problem with this one because I am a big softie. Every tenant who is back on rent has a reason he or she can't pay, and there are times that it is a heart-wrenching one. I have looked the other way for many tenants while they got their act together. There have been a few times that these tenants were able to get back on track, but there have been more situations where they have not been able to. Fortunately, I don't have this problem anymore because I hired an office manager to deal with the tenants. She is not a softie and sticks to the rules that she and I established.

Our rent is due on the 1st, and it's late after the 5th. On the 6th we send a letter reminding the tenants that they are past due and informing them that we will be filing eviction on the 10th. If a tenant contacts us and is in distress, we will put that person on a written payment plan with most of what he or she owes paid within 30 days.

If we don't get a response, we send the file to our attorney, whose fees are paid by the tenant if the tenant wants to stay (it's written in our lease). In our area you can get from an eviction filing to removal within four to six weeks. I have heard much longer time windows in other parts of the country -- all the more reason to file immediately and get the process moving. The tenant can always catch up after you file, and unfortunately some tenants won't take you seriously until you show them that you are willing to evict.

Conclusion

Don't get me wrong -- buying a rental property with great potential feels great. But potential is just that, and it will never be realized as cash flow until you implement a proper management plan.

Buying great deals is a necessary first step. Maintaining your rental's financial performance is the second step and your long-term wealth builder.

This article originally appeared on The Bigger Pockets Blog.

And you can protect that wealth by taking advantage of this little-known tax "loophole"

Recent tax increases have affected nearly every American taxpayer. But with the right planning, you can take steps to take control of your taxes and potentially even lower your tax bill. In our brand-new special report "The IRS Is Daring You to Make This Investment Now!," you'll learn about the simple strategy to take advantage of a little-known IRS rule. Don't miss out on advice that could help you cut taxes for decades to come. Click here to learn more.

Friday, September 19, 2014

Don't Let Media "Noise" Drown Out True Value

Signs of overvaluation and "irrational exuberance" abound in the market, and not surprisingly it is most often seen in the run-up of stocks with which we have daily familiarity.

We hear incessantly of Facebook Inc. (Nasdaq: FB) and Twitter Inc. (NYSE: TWTR) - when not checking them ourselves.

That lends some validity to the exuberance, as a ubiquitous presence in our lives can feel like a lock for growth potential, or permanence in the marketplace beyond challenge.

The tech sector as a whole has the ability to deliver tremendous returns - we've seen it often - which makes it all the more critical to use a few tools to screen out stocks of perceived value so we can invest in the true winners...

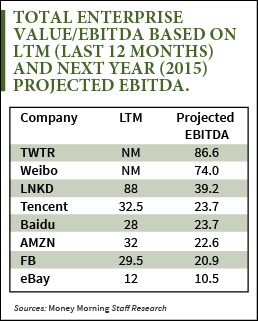

These Growth Rates Are Not SustainableThe following chart shows just how optimistically investors are discounting the future of a few social media and tech stocks that I've selected as a sample to examine.

The metric or ratio here is looking at total enterprise value to EBITDA (earnings before interest, taxes, depreciation, and amortization) more than five years into a central bank-induced bull market:

These are not multiples of earnings, which in the case of most of these companies would be considered fully-valued (with the exception of eBay); these are multiples of EBITDA (cash flow), since many of these companies have no earnings.

These are not multiples of earnings, which in the case of most of these companies would be considered fully-valued (with the exception of eBay); these are multiples of EBITDA (cash flow), since many of these companies have no earnings.

While these are unquestionably groundbreaking companies in cutting-edge industries, they are also operating in industries that have limited or no barriers to entry. And that is potentially a very big problem.

In an industry that thrives on creative destruction, optimism can often lead to despair as regulatory and technological changes wreak havoc on thin business models and market domination.

Some of these large companies like Facebook and Amazon.com, Inc. (Nasdaq: AMZN) will also confront the law of large numbers that inevitably limits their growth. Their growth rates inevitably slow. For example, this is something that investors in growing, well-known companies like Chipotle Mexican Grill, Inc. (NYSE: CMG) are also going to learn, to their disappointment.

This is one reason that Apple Inc. (Nasdaq: AAPL) trades at what seems to be a reasonable multiple; the company is just too large and is incapable of growing at the types of multiples seen at early-stage companies.

While the growth rates of some of the companies listed above has been extraordinary, they will inevitably slow. If they aren't able to demonstrate profitability sooner rather than later, investors will inevitably be disappointed. AMZN stock has been a notable exception to that rule, but soon will either have to make money or see its stock drop significantly. (Particularly as high-profile entrants such as Alibaba are poised to step into the lucrative e-commerce market.)

"Marquee" growth stocks will always trade at much higher multiples than the market. The reason is simple: they've captured the imaginations of investors and are at the center of a cultural, media, and economic revolution.

But by virtue of their epic valuations, they are highly vulnerable to sell-offs and changes in market psychology and investor whimsy. They are also vulnerable to the least sign of trouble or investor disappointment. When stocks are trading for a perfect ending, any blemish on that outcome can lead to dramatic sell-offs.

Easy Money Makes the Task Even More Daunting (and Important)Most importantly these stocks, as well as the broader market, are beneficiaries of the flood of liquidity coming from central banks and supporting the prices of all financial assets. With more than $4.5 trillion of excess liquidity sitting in global banks (and much more coming), the world is awash in more money than ever before.

Financial asset prices are being inflated far beyond their fundamental values, including Manhattan apartment prices, Miami condos, or pieces of fine art. Social media stocks are no different.

When Federal Reserve Chair Janet Yellen warned a couple of months ago that, among others, social media stocks had entered a bubble, that was like the judge at the Indianapolis 500 handing out speeding tickets. And investors reacted accordingly, bidding up those stocks further. Until central banks stop injecting monetary heroin into the veins of the financial system, the most speculative stocks will keep trading at valuations last seen during the Internet Bubble.

And we all know how that ended.

In an era of trading cycles accelerated by information exchanged at the speed of light, it remains more important than ever to separate the wheat from the chaff when it comes to true stock values. By applying relatively simple metrics, reading daily financial news rather than Twitter feeds, it can still be found in an inflated market.