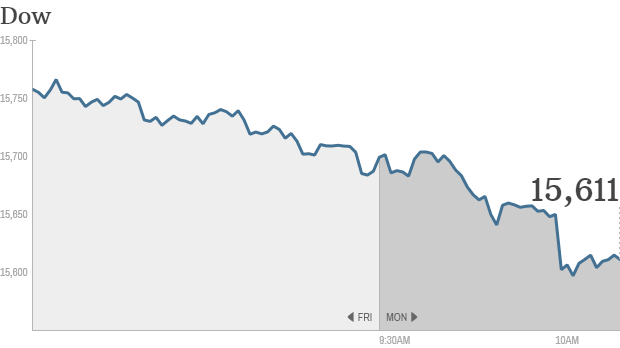

Click the chart for more stock market data.

NEW YORK (CNNMoney) Following the worst January in years, stocks continued to fall on the first trading day of February.The Dow tumbled more than 100 points, or about 1%, early Monday after a much worse-than-expected reading on manufacturing activity. The S&P 500 and Nasdaq were also down about 1%. So was CNNMoney's Tech 30 index.

Investors were disappointed after the Institute for Supply Management's monthly index showed that manufacturing activity last month expanded at its weakest pace since May.

The bad news comes as investors are still reeling from a rough January. Disappointing earnings and volatility in emerging markets sent stocks sharply lower during the first month of the year. The Dow tumbled more than 5% last month -- its worst January since 2009.

Many experts think the market could fall further, following big gains in 2013 and the fact that the stocks haven't taken a big breather in a while. Though stocks took a small step back last spring, they haven't experienced a correction, typically defined as a decline of 10% or more, in more than two years.

In corporate news, Herbalife (HLF) shares were higher after the company said fourth quarter earnings would top forecasts. The company also raised the amount of its planned share repurchase by $500 million. Hedge fund manager Bill Ackman has accused Herbalife of being a pyramid scheme. But the nutritional supplements marketer has refuted those claims.

Shares of Jos. A. Bank Clothiers (JOSB) declined after The Wall Street Journal reported that the company is in talks to buy fellow apparel retailer Eddie Bauer. The potential deal would be the latest twist in the battle between Jos. A. Bank and Men's Wearhouse (MW). Both retailers have offered to buy each other.

Shares of RadioShack (RSH) were higher as investors seemed to appreciate the company's self-deprecatory Super Bowl ad. Radio Shack showed that it was getting rid of its 1980s image and products and unveiling a new store. But even with Monday's move up, the stock is still well below its 52-week high.

Automakers are reporting January sales Monday. The news was mostly bad. Ford (F, Fortune 500). GM (GM, Fortune 500) and Toyota (TM) shares fell after posting sales declines in January that were even larger than what analysts were expecting. There was one b! right spot though. Chrysler reported an increase in sales that topped forecasts.

Restaurant operator Yum! Brands (YUM, Fortune 500) is set to release quarterly results after the closing bell.

European markets were weaker in morning trading as investors ignored reports of stronger manufacturing activity in the eurozone in January.

Many Asian markets were closed for the lunar new year but those trading moved lower, with the Nikkei in Japan declining by 2%. The benchmark Nikkei has tumbled 10.3% so far this year. That means the index is now undergoing a correction, after posting a whopping 57% gain in 2013 -- its biggest annual rise in over 40 years.

Traders in Asia were cautious after the release of weak official Chinese manufacturing data. Many emerging markets have suffered over the past few weeks as investors have moved money out of riskier markets in favor of relative safe havens. ![]()

No comments:

Post a Comment