Understanding the Coin Toss

In the short term, anything can happen; this is why the coin toss is an appropriate analogy for the stock market. Let's assume that at a given moment in time the stock could just as easily move up as it could move down (even in a range, stocks move up and down). Thus our probability of making a profit (whether short or long) on a position is 50%.

While hopefully no one would make completely random short-term trades, we will start with this scenario. If we a have an equal probability of making a quick profit (like a coin toss), does a run of profits or losses signal what future outcomes will be? No! Not on random trades. This is a common misconception. Each event still has a 50% probability, no matter what outcomes came prior.

Runs do happen in random 50/50 events. A run refers to a number of identical outcomes that occur in a row. Here is a table displaying the probabilities of such a run; in other words, the odds of flipping a given number of heads or tails in a row.

|

Run Length |

Chance |

|

1 |

50% |

|

2 |

25% |

|

3 |

12.5% |

|

4 |

6.25% |

|

5 |

3.125% |

|

6 |

1.5625% |

Here is where we run into problems. Let's say we have just made five profitable trades in a row. According to our table, which is giving us the probability of being right (or wrong) five times in a row based on a 50% chance, we have already overcome some serious odds. The odds of getting the sixth profitable trade looks extremely remote, but actually that is not the case. Our odds of success are still 50%! People lose thousands of dollars in the markets (and in casinos) by failing to realize this. The reason is that the odds from our table are based on uncertain future events and the likelihood they will occur. Once we have completed a run of five successful trades, those trades are no longer uncertain. Our next trade starts a new potential run, and after the results are in for each trade, we start back at the top the table, every time. This means every trade has a 50% chance of working out.

The reason this is so important is that often, when traders get into the market, they mistake a string of profits or losses as either skill or lack of skill. This is simply not true. Whether a short-term trader makes multiple trades or an investor makes only a few trades a year, we need to analyze the outcomes of their trades in a different way to understand if they are simply "lucky" or actual skill is involved. Statistics apply on all time lines, and this is what we must remember.

Long-Term Results

The above example gave a short-term trade example based on a 50% chance of being right or wrong. But does this apply to the long term? Very much so. The reason is that even though a trader may only take long-term positions, he or she will be doing fewer trades. Thus, it will take longer to attain data from enough trades to see if simple luck is involved or if it was skill. A short-term trader may make 30 trades a week and show a profit every month for two years. Has this trader overcome the odds with real skill? It would seem so, as the odds of having a run of 24 profitable months is extremely rare unless the odds have shifted more in his favor somehow.

Now what about a long-term investor who has made three trades over the last two years that have been profitable? Is this trader exhibiting skill? Not necessarily. Currently, this trader has a run of three going, and that is not difficult to accomplish even from totally random results. The lesson here is that skill is not just reflected in the short term (whether that is one day or one year, it will differ by trading strategy); it will also be reflected in the long term. We need enough trade data to accurately determine whether a strategy is significant enough to overcome random probabilities. And even with this, we face another challenge: While each trade is an event, so is a month and year in which trades were placed.

A trader who placed 30 trades a week has overcome the daily odds and the monthly odds for a good number of periods. Ideally, proving the strategy over a few more years would erase all doubt that luck was involved due to a certain market condition. For our long-term trader making trades that last more than a year, it will take several more years to prove that his strategy is profitable over this longer time frame and in all market conditions.

When we consider all time frames and all market conditions, we actually begin to see how to be profitable on all time frames and how to move the odds more on our side, attaining greater than a random 50% chance of being right. It is worth noting that if profits are larger than losses, a trader can be right less than 50% of the time and still make a profit.

How Profitable Traders Make Money

So, obviously people do make money in the markets, and it's not just because they have had a good run. How do we get the odds in our favor? The profitable results come from two concepts. The first is based on what was discussed above - being profitable in all time frames or at least winning more in certain periods than is lost in others.

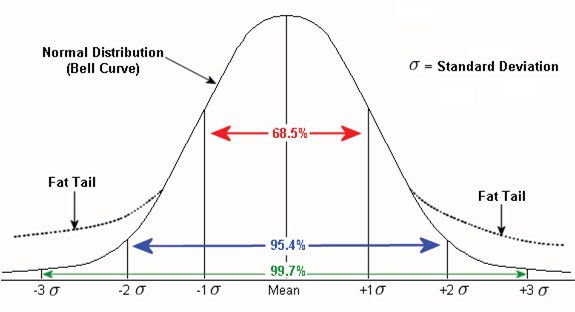

The second concept is the fact that trends exist in the markets, and this no longer makes the markets a 50/50 gamble as in our coin toss example. Stock prices tend to run in a certain direction over periods of time, and they have done this repeatedly over market history. For those of you who understand statistics, this proves that runs (trends) in stocks occur. Thus we end up with a probability curve that is not normal (remember that "bell curve" your teachers always talked about) but is skewed and commonly referred to as a curve with a fat tail (see the chart below). This means that traders can be profitable on a consistent basis if they use trends, even if it is on an extremely short time frame.

|

| Source: Stockcharts.com |

The Bottom Line

If trends exist, and we can no longer have a random sampling of data (trades) because a bias in those trades will likely reflect a trend, why is the 50% chance example above useful? The reason is that the lessons are still valid. A trader should not increase his or her position size or take on more risk (relative to position size) simply because of a string of wins, which should not be assumed to occur as a result of skill. It also means that a trader should not decrease position size after having a long, profitable run.

This information should be good news. New traders can take solace in the fact that their researched trading system may not be faulty, but rather is experiencing a random run of bad results (or it may still need some refining). It also should put pressure on those who have been profitable to continually monitor their strategies so they remain profitable.

This information can also aid investors when they are analyzing mutual funds or hedge funds. Trading results are often published showing spectacular returns; knowing a little more about statistics can help us gauge whether those returns are likely to continue or if the returns just happened to be a random event.

No comments:

Post a Comment